31+ How much mortgage can i qualify

You can also connect with a home mortgage consultant and have a conversation about your home financing needs your loan choices and how much you may be able to borrow. Compare Mortgage Options Calculate Payments.

Free 31 Credit Application Forms In Pdf

Your debt-to-income ratio DTI should be 36 or less.

. You can expect to pay a total of 36851040 over 30 years to pay off your whole mortgage assuming you dont make any extra payments or sell before then. These are some of the requirements you must meet to qualify. To qualify for a mortgage.

Converting construction loan to mortgage AJ Capital Receives 27M. This calculator computes how much you might qualify for but does not actually qualify you for a. According to the Mortgage Bankers Association the average mortgage loan is 239265.

The interest rate youre likely to earn. To qualify for a loan insured by the Federal Housing Administration your front-end ratio cannot exceed 31 percent. If you dont know how much your.

A Critical Number For Homebuyers. This means that your mortgage taxes and insurance payments shouldnt exceed 1960 per month and your total monthly debt paymentsincluding that 1960should be no. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle.

Insurance and other costs. If a private mortgage doesnt seem like the right fit for you but you cant qualify for a conventional loan here are a couple of alternatives to consider. According to this rule your mortgage.

One way to decide how much of your income should go toward your mortgage is to use the 2836 rule. If youre self-employed and do not have a W-2 form to prove your income consider getting a letter from an accountant or tax preparer who can show how much money you made in the past year. Can You Get Approved for a Mortgage if the Ratio Is Above 31.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. You can figure 31 percent of your gross monthly income to determine the. Your mortgage payment should be 28 or less.

Paid 29 an hour for the first 40 hours of the week and paid time and a half for hours. Your annual income before taxes The mortgage term youll be seeking. This is for things.

Weve all done a bit of hypothetical house hunting before right. How Much Mortgage Can I Afford With A Joint Income Of 50k. The application allows lenders to calculate how much borrowers can qualify for with a reverse mortgage by plugging in.

By Don Rafner i Before approving you for a mortgage loan lenders will look carefully at two of your debt-to-income. Your monthly recurring debt. These are your monthly income usually salary and your.

Your housing expenses should be 29 or less. However in this example Bob had more overtime in 2018 compared to 2017. Your monthly mortgage payment will also include a small USDA annual fee of 035.

What is DTI and how does it influence how big my mortgage can be. With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below. Even if the house you have your eye on is half the national average youre going to be looking for a six.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. How to Qualify for a USDA Loan. This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses.

Pin On Family Fun Food Frugality Group Board

Axos Financial Inc Free Writing Prospectus Fwp

Should You Skip Mortgage Payments If You Don T Have To

Axos Financial Inc Free Writing Prospectus Fwp

Axos Financial Inc Free Writing Prospectus Fwp

Axos Financial Inc Free Writing Prospectus Fwp

Axos Financial Inc Free Writing Prospectus Fwp

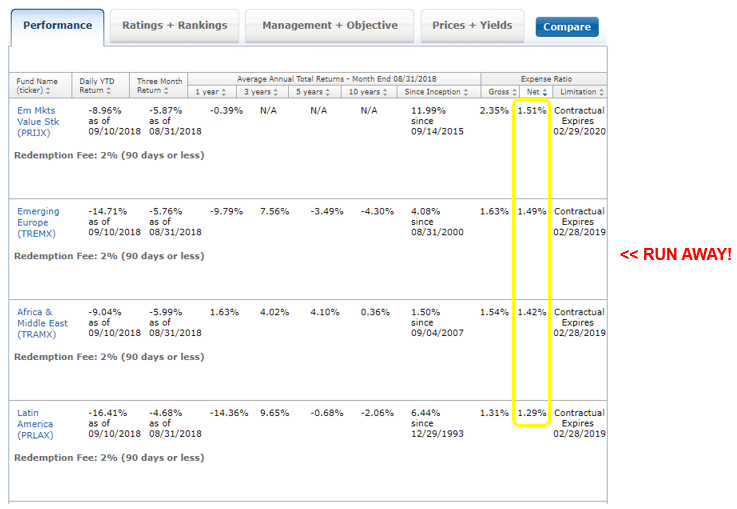

The Measure Of A Plan

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

Pin On Savings Side Gigs Financial Success

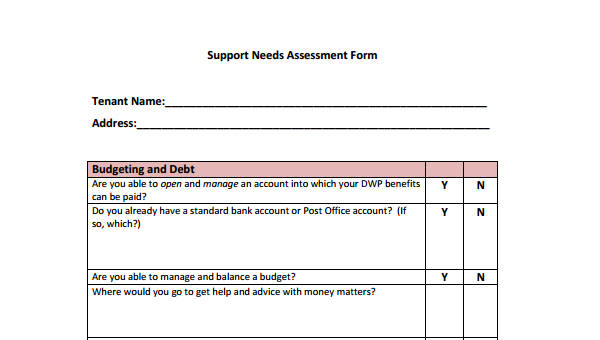

Free 31 Needs Assessment Forms In Pdf Excel Ms Word

Sandra Zachow Roscanu Real Estate Broker Re Max Action Linkedin

Deployment Checklist Deployment Checklist Military Deployment

Img008 Jpg