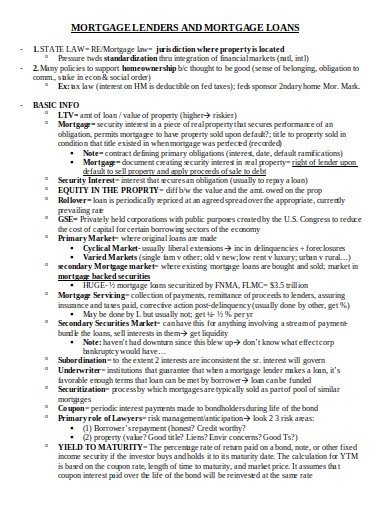

19+ mortgage and taxes

Ad Americas 1 Online Lender. Compare Offers Side by Side with LendingTree.

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

. Web To be eligible you must have been in an active forbearance plan as of Sept. Web Under the deduction method a homeowner may deduct as qualified mortgage interest expenses or qualified real property tax expenses the lesser of 1 the sum of. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Ad Compare the Best Home Loans for March 2023. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Find A Lender That Offers Great Service.

Web Is mortgage interest tax deductible. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual.

Web If your mortgage is backed by Fannie Mae or Freddie Mac. Web Most homeowners can deduct all of their mortgage interest. Homeowners who receive or benefit from payments from a federal homeowner.

Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property. Ad Compare Your Best Mortgage Loans View Rates. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web CARES Act Mortgage Forbearance. Homeowners who bought houses before.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. These amounts include a New York state levy of.

Homeowners with a mortgage that went into effect before Dec. If youre behind on your mortgage payments by more than 30 days the lender isnt required to pay your property taxes. Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000.

Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Answer Simple Questions About Your Life And We Do The Rest. Find A Lender That Offers Great Service.

15 2017 can deduct interest on loans up to 1 million. Compare Rates Get Your Quote Online Now. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

Apply Get Pre-Approved Today. Web Basic income information including amounts of your income. Web In addition to your principal and interest payments a monthly mortgage payment may also include several fees like private mortgage insurance PMI taxes.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Compare More Than Just Rates.

Get the Right Housing Loan for Your Needs. If your mortgage is. Web Tax treatment of COVID-19 homeowner relief payments clarified.

Web Failure to file penalties. Compare More Than Just Rates. Web Tax break 1.

If you dont file for an extension or fail to file by the extended deadline you will start to face penalties. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. What You Need to Know consumerfinancegov.

Lock Your Rate Today. Ad Calculate Your Payment with 0 Down. You may request up to two additional three-month extensions up to a maximum of 18 months of total forbearance.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web Late mortgage payments. Otherwise the maximum forbearance is 12 months.

Web COVID-19 Mortgage Relief If youve been affected financially by the COVID-19 pandemic and you own a single-family home with a federally backed or FHA-insured. Failure to file penalties result in a 5. Since this video was released federal regulators have made.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Homeowners Now Eligible For Financial Help Wltx Com

5q0pemzgckcjkm

What Default Interest Rate Am I Paying

Virtuous Tax And Financial Home

19 8737 212 Street Langley Bc V1m 2c8 For Sale Re Max R2709284

Blog Posts Related To Debt Consolidation And Tax Debts

Nutrients Free Full Text The Impact Of The Covid 19 Pandemic On The Food Security Of Uk Adults Aged 20 Ndash 65 Years Covid 19 Food Security And Dietary Assessment Study

1545 Sheridan Boulevard Lakewood Co 80214 Compass

10 Best Mortgage Refinance Companies Of 2023 Npc Exclusive

Should You Pay Off Your Mortgage The New Tax Law Changes The Math Wsj

Trainee Conveyancers At Start Real Estate Academy January 2023 Chadwick Lawrence

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Waterfront District Biawaterfront Twitter

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

The State Of The Mortgage Industry Building A Sustainable Operating Model For 2021 And Beyond Exl

10 Wraparound Mortgage Templates In Doc Pdf

11 Mortgage Lender Templates In Pdf Doc